The Profound Impact of Gambling on Your Credit Score

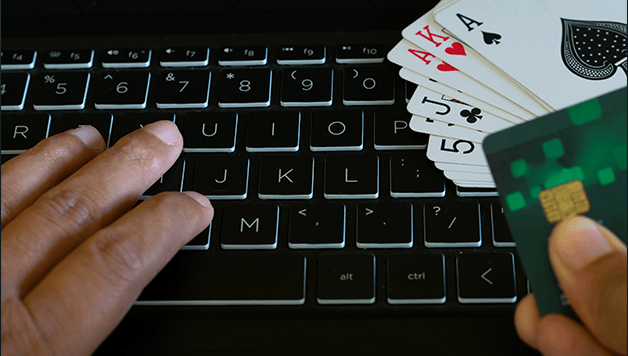

Gambling—whether it’s a night out at the casino, an online spree, or a bet on the races—can have a big impact on your finances. And with that comes an effect on your credit score, for better or (more likely) for worse.

In this guide, we’re going to break down the link between gambling and your credit score, and help you understand the potential pitfalls so you can stay one step ahead.

Understanding Credit Scores

Your credit score is basically a report card for your financial habits. It’s a number that banks and lenders use to figure out if they want to lend you money—and at what interest rate.

It’s calculated using several factors, including:

- Payment History: This is the big one. Have you made payments on time for your credit cards, loans, and bills? If yes, great—if no, your score takes a hit.

- Credit Utilization: How much of your available credit are you using? If you’re maxing out your cards, that’s a red flag for lenders.

- Length of Credit History: A longer history can work in your favor, especially if it shows a pattern of responsible management.

- Types of Credit Used: Lenders like to see a mix—credit cards, installment loans, mortgages—because it shows you’re capable of handling different kinds of credit.

- New Credit Applications: Each time you apply for credit, a “hard inquiry” shows up on your report, which can lower your score a bit.

All these factors come together to create your credit score, which is how lenders assess how risky it is to lend you money.

The Impact of Gambling on Credit Scores

Gambling can have a profound impact on your credit score in ways that might not be obvious at first. Whether it’s a quick bet or a more serious habit, the consequences can ripple through your entire financial life. Let’s go over exactly how gambling affects your credit score, so you can understand the risks and make informed choices that are right for you.

1. Increased Debt

One of the biggest risks when it comes to gambling is debt. Gambling losses can lead to excessive spending, which often means relying on credit cards or loans to cover bills and other expenses. When this happens, it can start to spiral out of control, leaving you stuck in a cycle of borrowing just to make ends meet.

The Debt-Gambling Cycle

If you lose money gambling, it can be tempting to keep going to try to win it back, but this often leads to more losses, borrowing, and spiraling debt. As debt increases, so does your credit utilization, dragging down your credit score. To avoid this, set a strict budget upfront that you can afford to lose. Many casinos offer tools like deposit limits to cap spending, time limits to control gambling sessions, and self-exclusion options to ban yourself. Using these tools can help you stick to your budget and protect your financial health, even if it’s not always easy.

2. Late or Missed Payments

Another significant impact of gambling on your credit score is the potential for late or missed payments on your bills and credit card obligations. When the money spent on gambling leaves you unable to make timely payments, your payment history will suffer. Late or missed payments are among the most influential factors in determining your credit score.

3. Chasing Losses

The urge to chase losses—to keep gambling in an attempt to get back what you’ve lost—is one of the worst habits a gambler can fall into. It creates a vicious cycle of financial instability and can lead to a growing mountain of debt. That debt often leads to missed payments, which, as we’ve already mentioned, tanks your credit score.

4. Applying for Loans or Credit Cards

When gambling losses mount, some people turn to new credit cards or loans to cover costs. But every time you apply for credit, a “hard inquiry” hits your credit report, which can lower your score. If lenders see too many inquiries in a short time, they might think you’re desperate or financially unstable—not a good look.

5. Bankruptcy

In extreme cases, uncontrolled gambling can lead to bankruptcy. Bankruptcy is a financial last resort, and it sticks around on your credit report for up to 10 years. It’s one of the most damaging things that can happen to your credit score, making it tough to get loans or even rent an apartment for years to come.

It’s important to remember that the exact impact of bankruptcy on your credit score can vary based on your individual credit history and other factors, but generally, it’s an event that has a particularly severe impact on your credit score.

Strategies to Mitigate the Impact

If you’re dealing with the effects of gambling on your credit score, don’t lose hope—there are ways to turn things around. Here are some proactive strategies to help.

1. Seek Professional Help

If you’re struggling with a gambling addiction, seeking professional help is the best thing you can do. Whether it’s a therapist or a support group, having guidance can help you get a handle on the problem and prevent further financial damage.

Gambling addiction is complex, and getting the right help can make all the difference—not just for your finances, but for your overall well-being.

2. Prioritize Debt Repayment

Once you’ve taken steps to address the gambling addiction, the next crucial step is to create a detailed plan to systematically pay down your existing debts.

Here are some things to consider:

- Focus on high-interest obligations first: Start by tackling credit card balances, personal loans, and other high-interest debt. These debts should be your top priority because their interest charges can compound fast, making it even harder to make progress.

- Utilize debt consolidation or balance transfer options: If you have multiple credit cards with varying interest rates, consider consolidating your debt into a single, lower-interest loan or credit card. This can simplify your payments and potentially save you money in interest charges, giving you some breathing room.

- Negotiate with creditors: If you’re struggling to keep up with payments, don’t hesitate to reach out to your creditors and explain your situation. Many creditors are willing to work with you by offering a payment plan, temporarily reducing interest rates, or even waiving certain fees. It might feel daunting, but honesty can go a long way.

Essentially, you want to make sure lenders know you take debt repayment seriously. Improving your credit utilization ratio is a good way to say to lenders: “Look, I’m serious about managing my own finances.”

3. Limit Gambling Activities

One of the best ways to stop gambling from hurting your credit is to limit your gambling in the first place.

Here’s how you can do it:

- Set a budget: Decide how much you’re willing to lose before you even start gambling. Stick to that number no matter what. Be honest with yourself—only gamble what you can truly afford to lose without it affecting your daily life.

- Avoid using credit cards: Don’t use credit cards for gambling. It’s too easy to end up with high-interest debt that piles up fast. Once you’re in debt, it’s much harder to enjoy gambling as a fun activity.

- Resist chasing losses: If you lose, don’t try to win it back. Chasing losses usually leads to more losses, and more debt. Accepting losses as part of the risk can help keep gambling in check and prevent emotional decisions.

- Use self-exclusion programs: Many casinos and online platforms offer self-exclusion programs. They can help you take a break and reduce the urge to gamble. Self-exclusion is a powerful way to put physical and emotional distance between yourself and gambling opportunities when you need it most.

These steps can help you avoid the downward spiral of debt and keep your credit score intact.

4. Monitor Your Credit Report

Keeping an eye on your credit report is one of the best ways to catch problems early.

Here’s what to do:

- Check for accuracy: Make sure all the information is right. Look at your payment history, credit utilization, and any new inquiries. Errors are more common than you might think, and correcting them can make a big difference.

- Dispute any errors: If you see mistakes or anything that looks suspicious, report it to the credit bureau and get it corrected. Errors can hurt your score, so it’s important to deal with them as soon as possible.

- Track changes: Watch your credit report over time. If you notice changes you don’t expect, address them quickly. Unexpected drops in your score might mean unauthorized activity or identity theft.

By staying on top of your credit report, you can fix issues before they get worse and keep your financial profile healthy. It’s all about being proactive and protecting yourself.

5. Rebuild Your Credit

If your credit score has taken a hit, don’t worry—it’s possible to rebuild it. It will take some time and dedication, but there are clear steps you can take to get things moving in the right direction.

Here are some practical ways to do it:

- Get a secured credit card: These cards need a security deposit, which becomes your credit limit. Use it wisely, and always pay on time. It’s a great way to start rebuilding. Secured cards are designed for people looking to rebuild, so they’re an accessible option.

- Become an authorized user: Ask someone you trust to add you as an authorized user on their credit card. It can help boost your score thanks to their good credit history. Just make sure it’s someone who uses credit responsibly—you want their good habits to rub off on your credit report.

- Look into credit-builder loans: These are loans designed to help people build credit. The loan amount is kept in a savings account until you pay it off. This helps establish a positive payment history, and once it’s paid off, you get access to the saved funds.

- Maintain a healthy credit mix: Try to have different types of credit, like credit cards and installment loans. It shows lenders you can handle a variety of financial responsibilities. Having a mix, and managing it well, proves you’re not a risk when it comes to borrowing.

By making on-time payments and being careful with your credit, you can slowly bring your score back up and get access to better financial opportunities. It takes time, but every small step gets you closer to where you want to be.

Final Thoughts from HeadlineCasinos Experts

Gambling can have a profound effect on your credit score—sometimes in ways you might not expect. However, understanding the risks and taking steps to mitigate them can make a big difference. Addressing the core problem, whether it’s gambling addiction or simply poor money management, is crucial to getting back on track.

The journey to rebuilding your credit score after gambling setbacks can be long, but with discipline, support, and smart financial decisions, you can regain control. Remember, it’s about progress, not perfection. Each step you take toward responsible financial management brings you closer to a more secure future.