Skrill - formerly known as Moneybookers - a versatile e-wallet

Skrill is an electronic payment system. Established in 2001, it was originally known as "Moneybookers". Back then, Moneybookers billed itself as a "money service business", providing online customers with a comprehensive set of payment and financial services.

Today, Skrill can be used to make payments electronically to thousands of online merchant and services sites, with support for most major currencies.

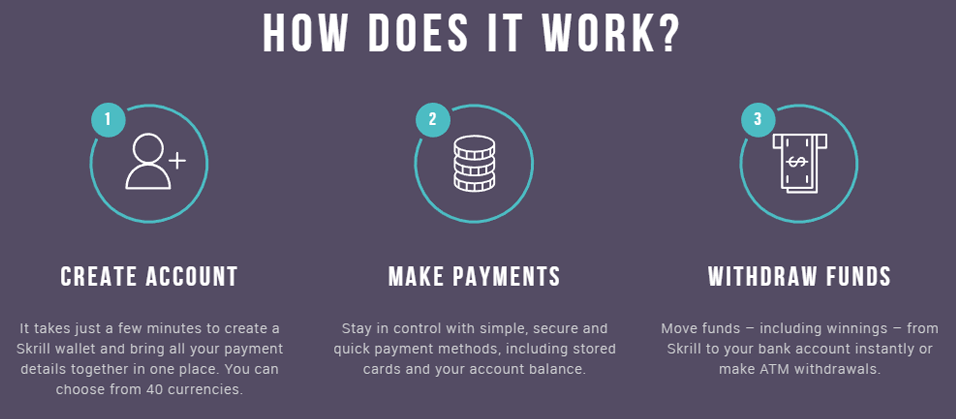

How Does Skrill Work?

Skrill is essentially an e-wallet service that provides users with a personal internet bank account. This account can be funded via any number of methods (more details on funding a Skrill account below).

Once funded, the account can be used to make payments online to any website that accepts Skrill as a payment method. Any funds that you win from an online casino can also be withdrawn into your Skrill account. From there, the funds can be withdrawn into a bank account, a debit or credit card account, or via a check or money order.

You may also use these funds for making payments to other retail or service sites on the Internet or for making new deposits into an online casino account.

| Skrill (Moneybookers) Facts | |

|---|---|

| Type | e-Wallet |

| Deposits | Yes |

| Withdrawals | Yes |

| Deposit Fees | Bank Wire deposits: Free, Visa and MasterCard deposits: 1.9% of uploaded amount |

| Withdrawal Fees | Skrill Card ATM withdrawals: 1.75%, Bank withdrawals to bank accounts: €5.50, Credit/Debit card withdrawals: 7.5% |

| Typical Casino Limits | Maximum daily limit - Identity verification not completed: €750 (verified card), €135 (unverified card) Identity verification completed: €5,000 (verified card), €135 (unverified card) |

| Headquarters | United Kingdom, with offices in the United States, Austria, and Sweden |

| Contact Details | Email: [email protected], Phone: 800-238-9984 |

| Website | https://www.skrill.com |

How to Create a Skrill Account

Creating a Skrill account is free, fast, and easy, and can be done within a few minutes at the company's website. The only requirement is a valid email address wherein you will receive the email with which to confirm your account registration.

Keep in mind that if you wish to use your account to make a deposit in an online casino or perform any other online payment transactions, you will be required to verify your account. The process typically involves linking or associating your Skrill account with a credit card or bank account.

Funding Your Skrill Account / Making A Transfer to A Casino Account

There are many ways by which you can fund your Skrill account, including:

- Bank wire transfer

- Deposit from a credit or debit card

- Other e-wallet services

- Local funding (certain locations only)

Bank wire transfers may take anywhere from two to five days before the funds will appear in your online casino account. Before you will be able to fund your Skrill account via a debit or credit card, you will first have to verify your card at the Skrill website.

Depending on your country of residence, you may be able to fund your Skrill via local funding.

In order to make a deposit into an online casino account via Skrill, you will have to perform the following procedure:

- Go to the casino's "deposits" page.

- Choose "e-wallet" as the deposit method.

- Select "Skrill" from the list of deposit methods supported.

- Specify the amount you wish to deposit.

- Provide details of your Skrill account.

Keep in mind that some casinos may still have Skrill listed with its former name "Moneybookers". This shouldn't be a problem, as the link will point back to the current Skrill service.

Making a Withdrawal From Skrill

In order to withdraw funds from an online casino account into a Skrill account, you will have to go through the following process:

- Go to the casino's "cash out" page.

- Select "e-wallet" as the withdrawal option.

- Choose "Skrill" from the e-wallet services offered.

- Specify the amount you wish to withdraw.

- Provide details of your Skrill account.

Once the funds are in your Skrill account, you can withdraw them via the following methods:

- Postal check

- Wire transfer

- Automated bank transfer

- Withdrawal to Visa or MasterCard credit card

Details on withdrawal fees for these methods are outlined below.

Security and Privacy of Your Personal Information

All transactions performed via Skrill are fully protected by the company's advanced data encryption systems, and users remain totally anonymous. The company utilizes a two-factor authentication (2FA) system that provides an added layer of security to most commonly used data security systems.

With its multi factor authentication system, users are required to provide the following in order to gain access to their accounts:

- Username

- Password

- Specific personal information

Along with the username and password, the use of the personal information helps ensure that only the owner is able to gain access to the account. This also makes it more difficult for unauthorized parties to harvest an account owner's identity or personal data.

Fee Summary

There are no fees charged for opening and maintaining an account with Skrill, although fees may be charged for certain transactions, including deposits and withdrawals.

There is no charge for funding a Skrill account via a bank wire transfer. Keep in mind however that your bank may charge a fee for such transactions.

When funding an account via Visa or MasterCard, you will be charged a fee equivalent to 1.9% of the amount that you wish to deposit.

There is a charge of 1.75% when making a withdrawal from an ATM with your Skrill Card. Withdrawals from a Skrill account to a bank account will entail a fee of €5.50.

If you wish to withdraw funds from your Skrill account into your credit/debit card account, you will have to pay a fee equivalent to 7.5% of the withdrawal amount.

If you wish to make a deposit or a withdrawal in a currency that is different from the currency of your Skrill account, you will have to pay a foreign exchange fee.

There is also a fee of €3 for every month that your account remains dormant after a 12 month period. This amount will be deducted from your Skrill account as long as there are funds in it.

Loyalty program

Skrill used to offer loyal customers access to an exclusive VIP program that provided the following perks:

- Enhanced user protection

- 100% money back guarantee

- 24-hour support, seven days a week

- Loyalty points

- Reduced fees

However, the loyalty points program was discontinued beginning on June 30, 2016. Since then, Skrill has yet to make an announcement regarding a similar rewards program.

Customer Service

Skrill's customer support staff can be reached via phone, email, or the online contact form provided on the company's website. The site also has a FAQ with answers to common customer concerns and queries.